Forecast setup

It is difficult to make predictions, especially about the future. (Niels Bohr; possibly an old Danish proverb)

- It is fairly easy to make forecasts for variables that have a decently stable pattern over time

- Weekly FastMovingGoods product sales, sensor of gadgets used regularly

- It is very hard to make forecasts of really interesting variables

- GDP with Recession, crisis,

- High tech gadgets with new products

- Stock market prices

- why???

Forecasting basics

- Forecasting is a special case of prediction.

- Forecasting makes use of time series data on \(y\), and possibly other variables \(x\).

- The original data used for forecasting is a time series from 1 through \(T\), such as \(y_1, y_2, ..., y_T\)

- The forecast is prepared for time periods after the original data ends, such as \(\hat{y}_{T+1}, \hat{y}_{T+2}, ..., \hat{y}_{T+H}\). This is the live time series data.

Forecast horizon

- What is it?

- The length of the live time series data (here \(H\)) = the forecast horizon.

- Short-horizon forecasts are carried out for a few observations after the original time series;

- 5-10 years of monthly data \(\rightarrow\) forecast a 3-12 months ahead

- 10 years of quarterly data \(\rightarrow\) predict ahead of a few quarters

- Long-horizon forecasts are carried out for many observations.

- Often: data on activity, operation

- 5 years of daily data \(\rightarrow\) forecast daily ahead for a year

- 2 months of hourly activity data \(\rightarrow\) predict weeks ahead

Cross-validation in time series

- Cross-validation is essential in time series

- The ability to build a model that works well for the future, without overfitting

- But it is tricky

- you cannot just randomly split the data.

- Time series is time dependent

- But there are Options

Cross-validation: Options

- OP1: Select a “test set” of few periods where to evaluate the model

- Use all information before and the test set to build the model

- And a common “end of sample” test set

- Good for long-horizon forecasts

- OP2: Select a “test set” of few periods where to evaluate the model

- Use “X” periods before the test set to build the model

- Repeat with the next Window

- Good for short-horizon forecasts

Message:

- The strategy for prediction and cross-validation depends on the forecast horizon.

- For short-horizon forecasts, you really need to consider the time dependence of the data.

- For long-horizon forecasts, you try to capture long-term patterns in the data.

Long-horizon:

Seasonality, trend and predictable events

Long-horizon forecasting: Seasonality and predictable events

- Look for aspect of data that matter for long time

- Focus on predictable aspects of time series

- Trend(s) + Seasonality + Other regular events

- Two options to model trend: estimate average change or trend line

- \(y = f(T,S,E)\) or

- \(\%\Delta y \text{ or } \Delta y =g(T,S,E)\)

- Seasonality: ie model with set of variables (11 months), maybe interactions

- Other regular events - set of binary vars (War, Covid, New Policy, etc)

Long-horizon forecasting: Growth rates

First model - estimate average change:

\[\hat{\Delta}y = \hat{\alpha}\]

For prediction this means:

\[

\begin{aligned}

\hat{y}_{T+1} &= y_T + \hat{\Delta}y \\

\hat{y}_{T+2} &= \hat{y}_{T+1} + \hat{\Delta}y = y_T + 2 \times \hat{\Delta}y \\

\dots \\

\hat{y}_{T+H} &= y_T xx+ H \times \hat{\Delta}y

\end{aligned}

\]

Long-horizon forecasting: Trends

Estimate trend line: \[\hat{y}_t = \hat{\alpha} + \hat{\delta}t\]

- \(\hat{\alpha}\) is predicted \(y\) when \(t = 0\)

- \(\hat{\delta}\) tells us how much predicted \(y\) changes if \(t\) is increased by one unit.

- You can also use more complex trends. (but one should still be concerned about overfitting)

Long-horizon forecasting: Trends - compare options

- Difference in models

- Model changes:

- Assumes that \(y\) continues from the last observation, and increase by the same amount each time. What if Last observation is unusual?

- Model trend line

- Assumes that \(y\) remains close to the trend line. Last unusual observation would not matter for the forecast, because it would be the trend line.

- Neither approach is inherently better than the other

Long-horizon forecasting: Seasonality

- Capture regular fluctuations

- Months, days of the week, hours, combinations

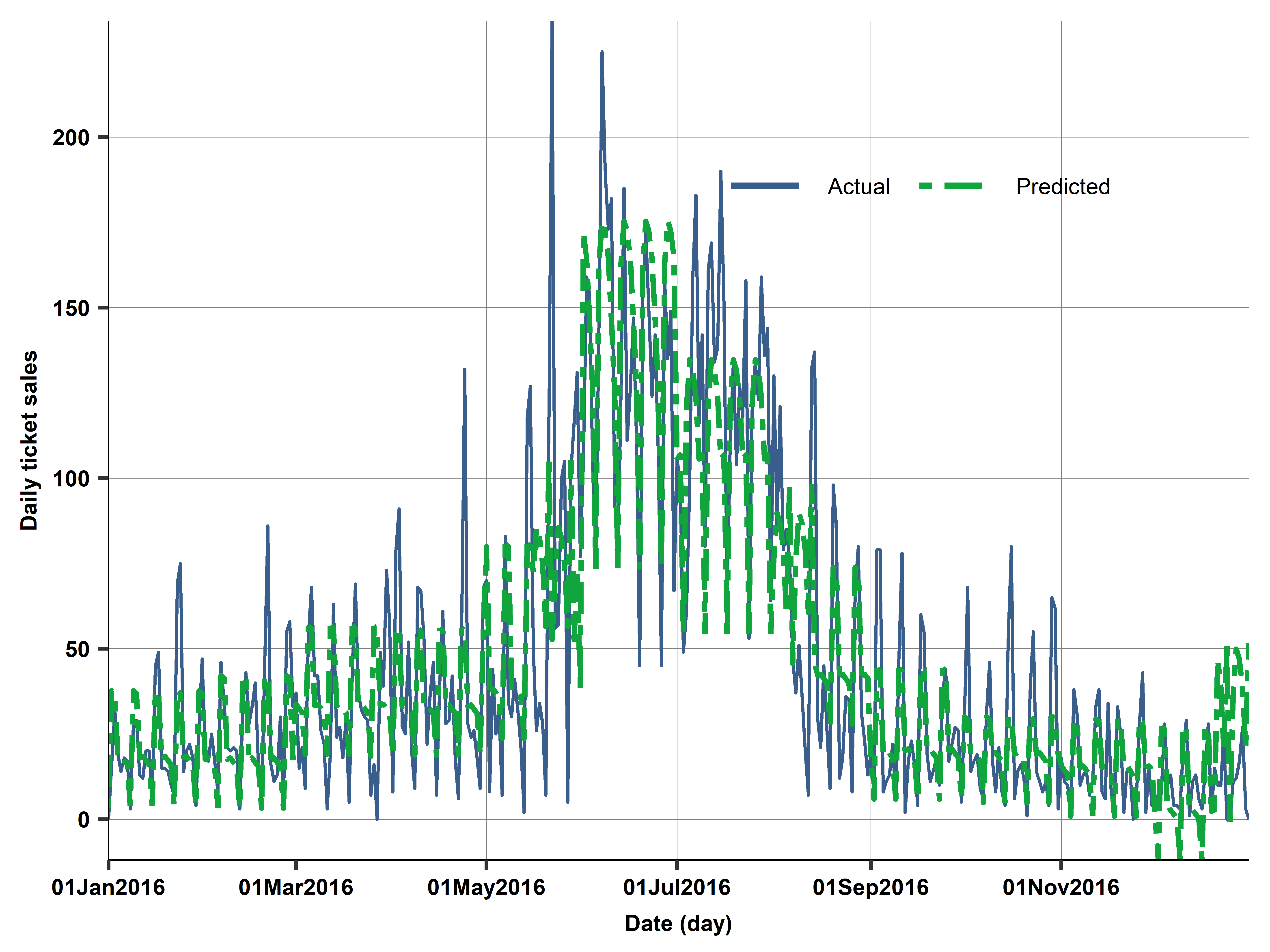

Case study: ABQ swimming

- Swimming pool data

- Albuquerque (ABQ), New Mexico, USA

- Big data, transaction level entry data logged from sales systems

- 1.5m observations

This CS:

- Sample: Single swimming pool

- Aggregated: number of ticket sales per day

- After some sample design - regular tickets only

Case study: Modelling

- Trend is simple – use simple linear trend: \(\alpha t\)

- Maybe not really important at all

- Perhaps consider exponential trend? (log-linear model)

- Seasonality is important and tricky

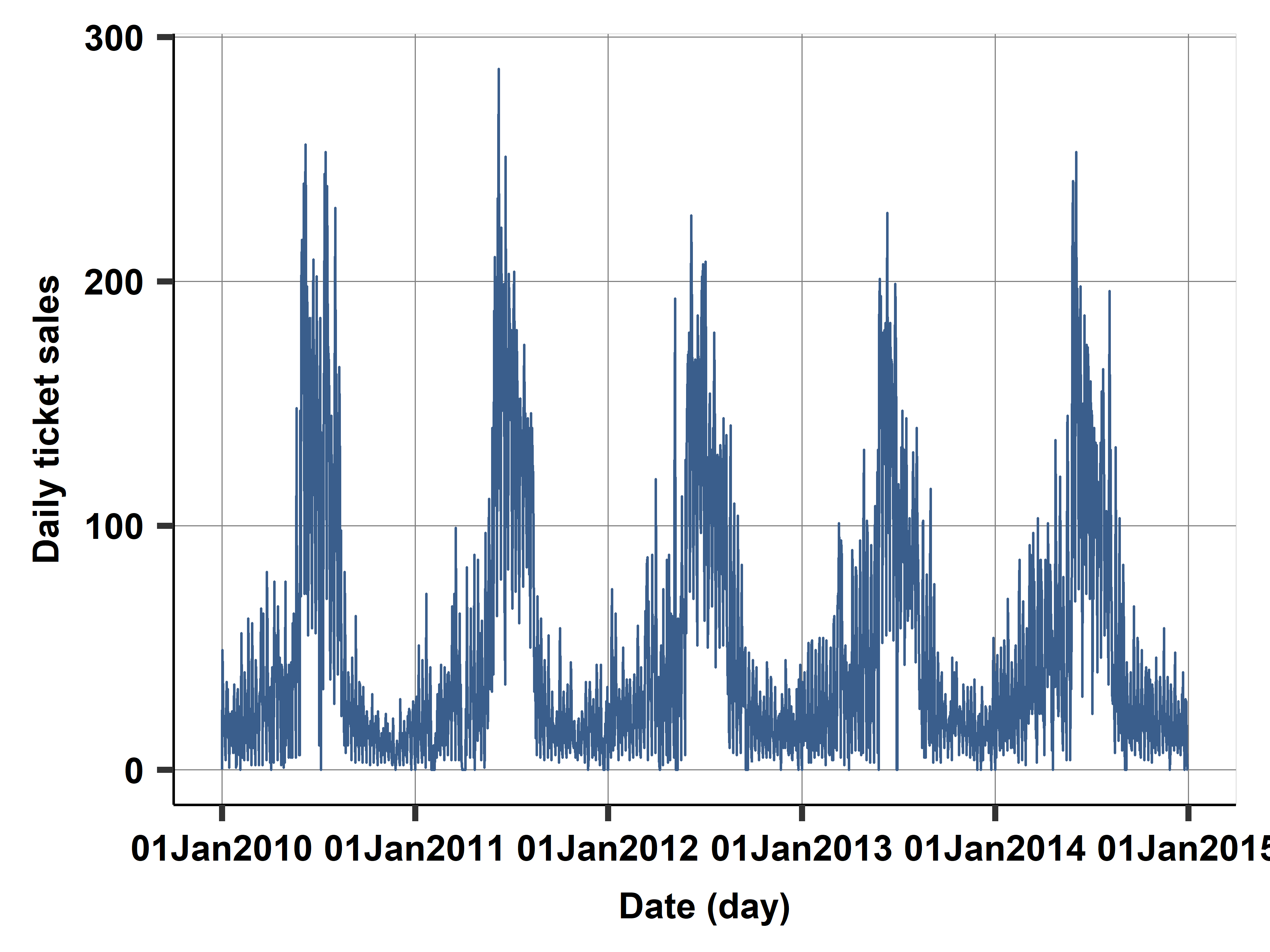

Case study: Daily ticket sales

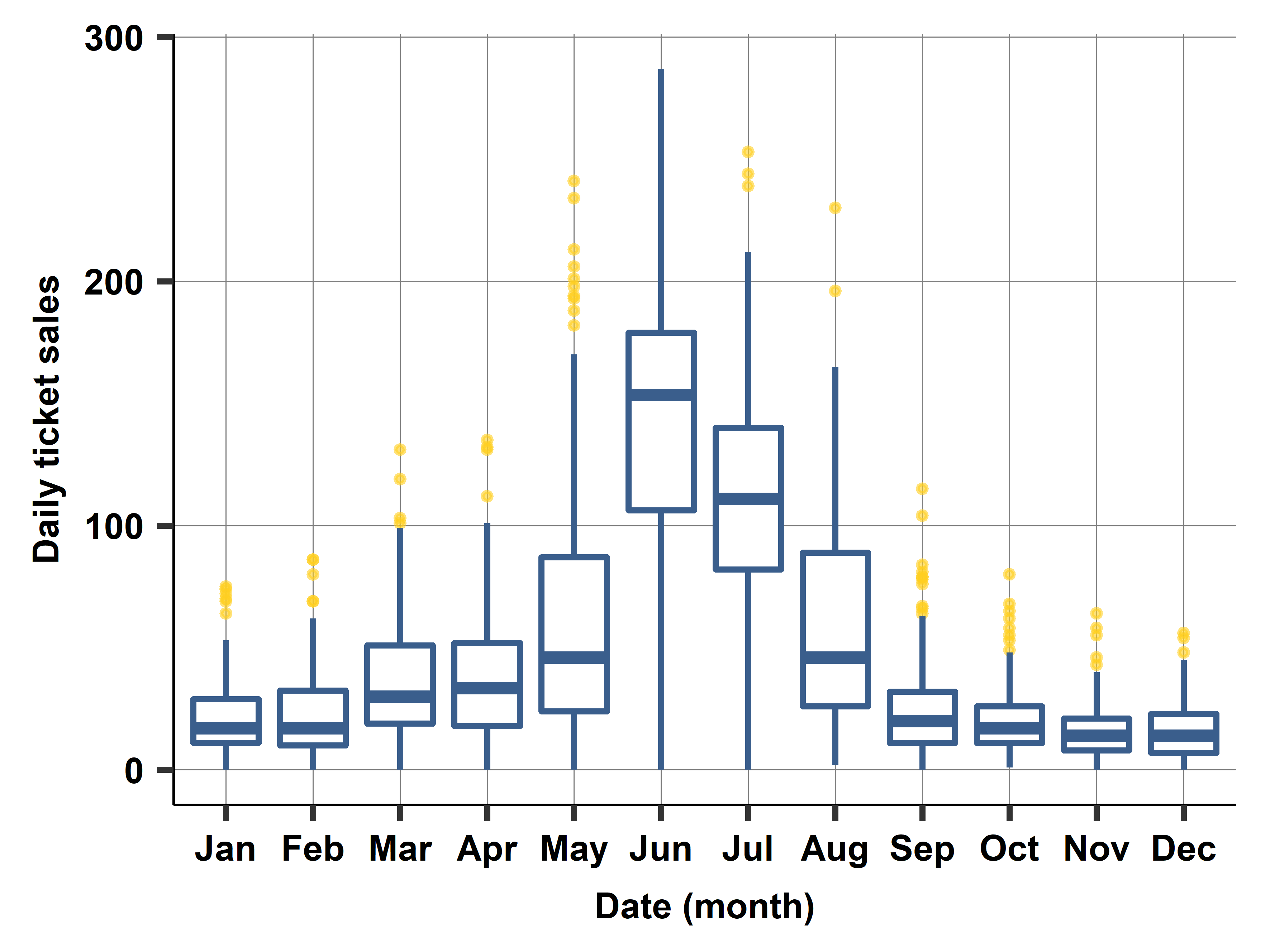

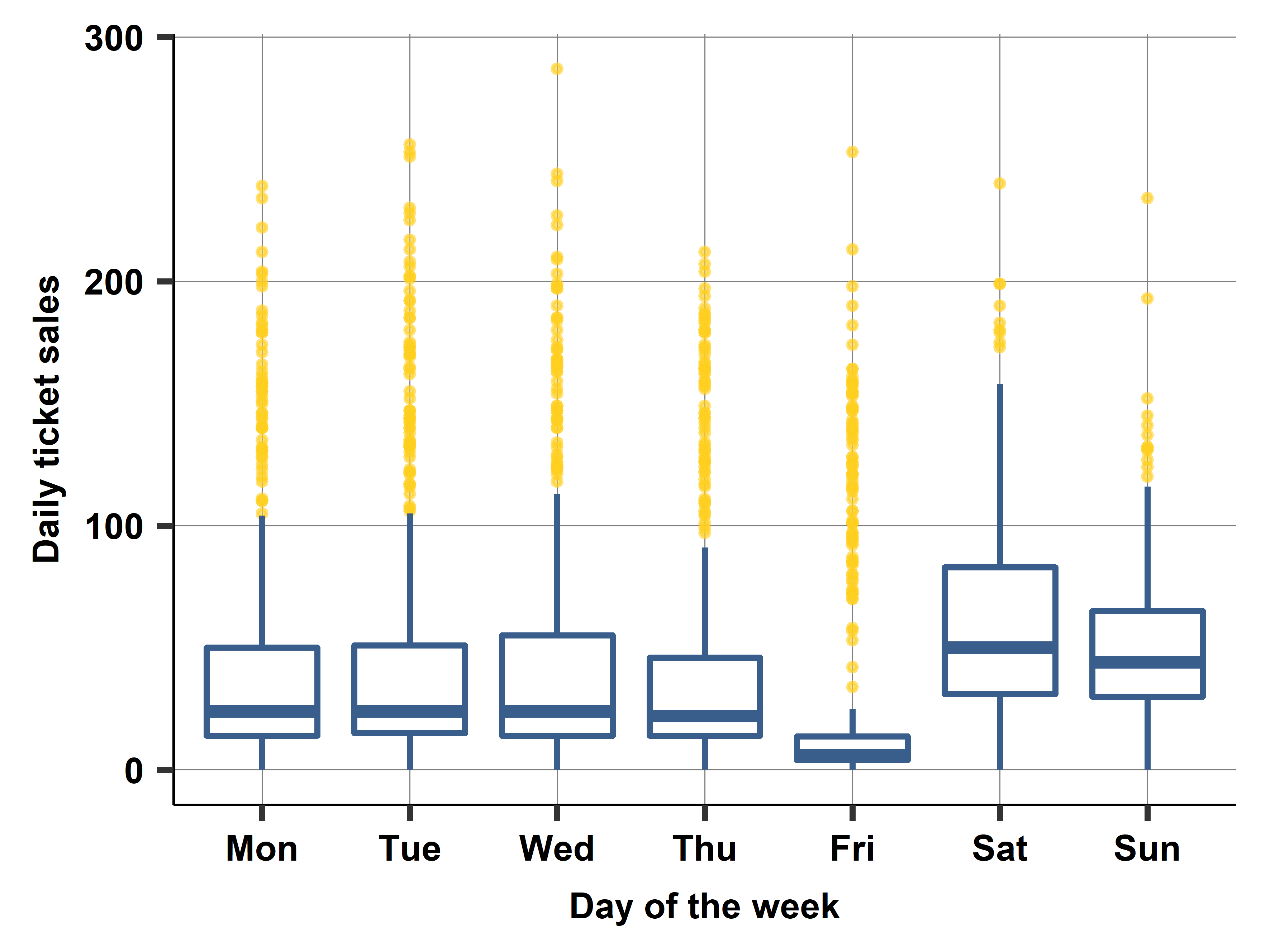

Case study: Monthly and daily seasonality

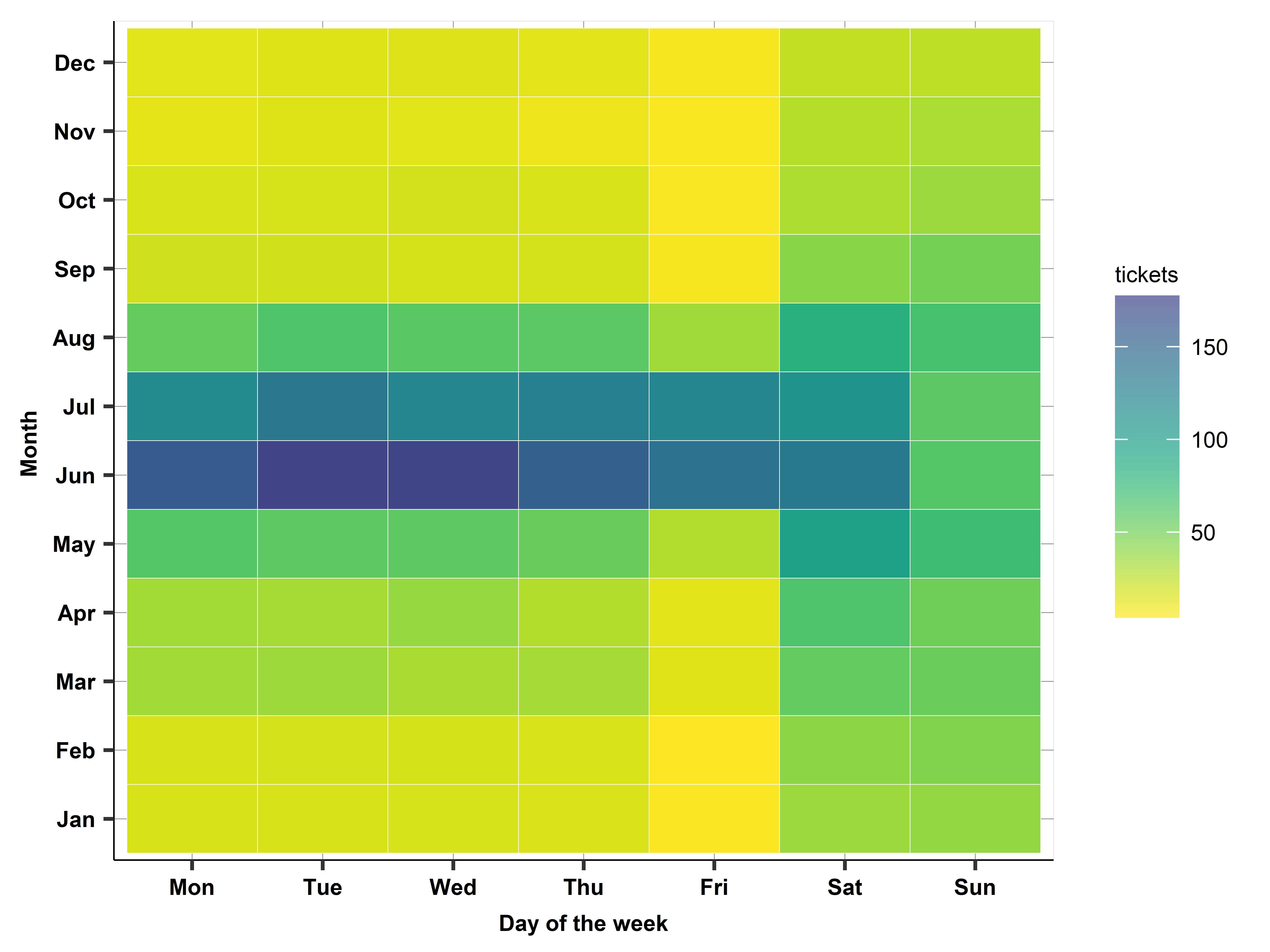

Case study: Daily ticket sales: A heatmap

- Tool to model seasonality

- Each cell is average sales for a given combination of day and month over years

- Colors help see pattern

Case study: Modeling

- Trend is simple - linear trend

- Seasonality is tricky - need to model and simplify

- Months

- Days of the week

- USA holidays (dummies)

- Summer break (depends?)

- Interaction of summer break and day of the week

- Interaction of weekend and month

Case study: Model features and RMSE

| M1 |

X |

X |

|

|

|

|

32.35 |

| M2 |

X |

X |

X |

|

|

|

31.45 |

| M3 |

X |

X |

X |

X |

|

|

29.46 |

| M4 |

X |

X |

X |

X |

X |

|

27.61 |

| M5 |

X |

X |

X |

X |

X |

X |

26.90 |

| M6 (log) |

X |

X |

X |

X |

X |

|

30.99 |

| M7 (Prophet-ML) |

X |

X |

X |

X |

N/A |

|

29.47 |

Note: Trend is linear trend, days is day-of-the-week, holidays: national US holidays, school*days is school holiday (mid-May to mid-August and late December) interacted with days of week.

RMSE is cross-validated.

Source: swim-transactions dataset.

Daily time series, 2010–2016, N=2522 (work set 2010–2015, N=2162).

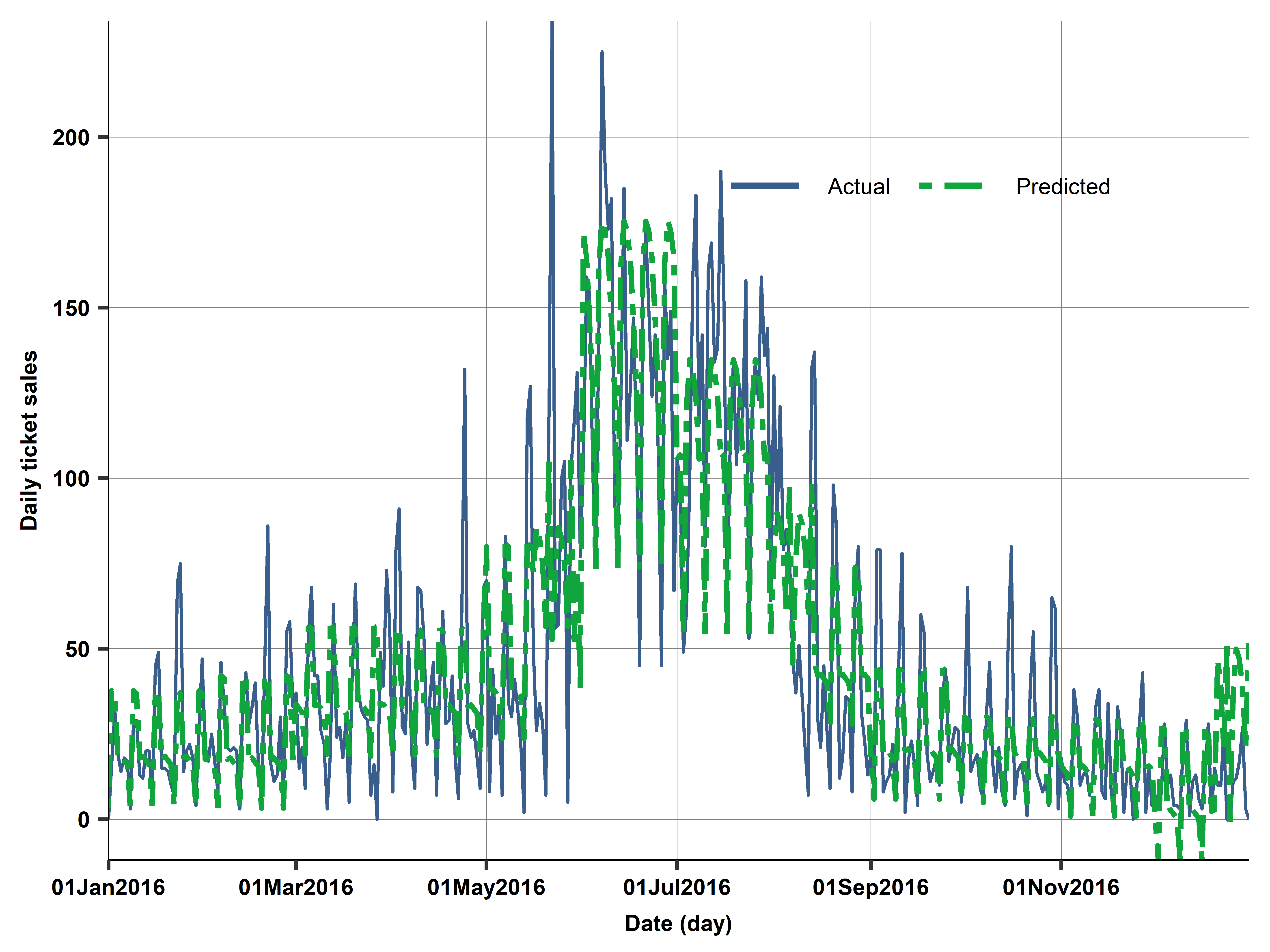

Case study: Compared actual vs predicted on holdout set (2016)

Case study: Diagnostics - holdout set (2016)

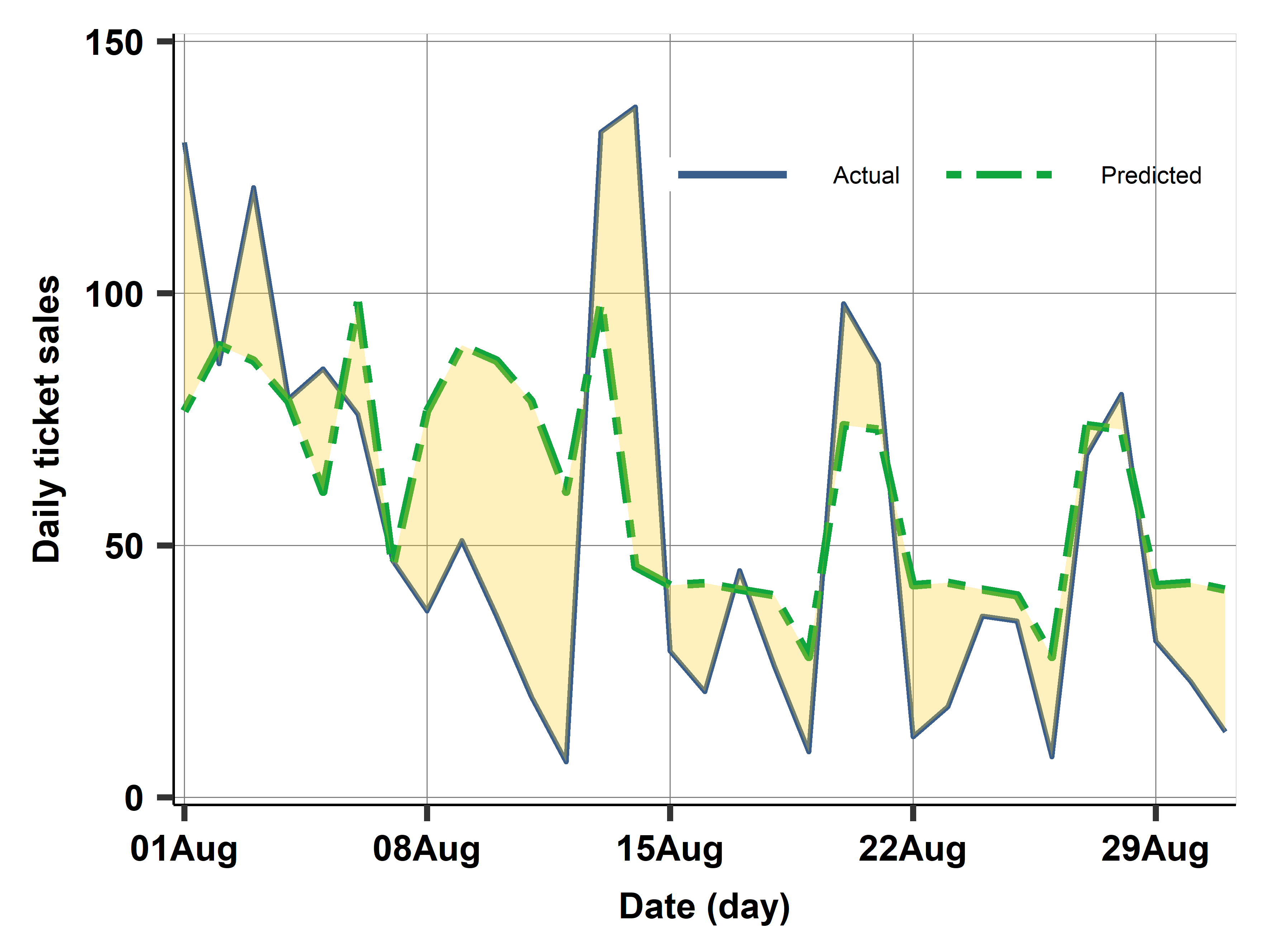

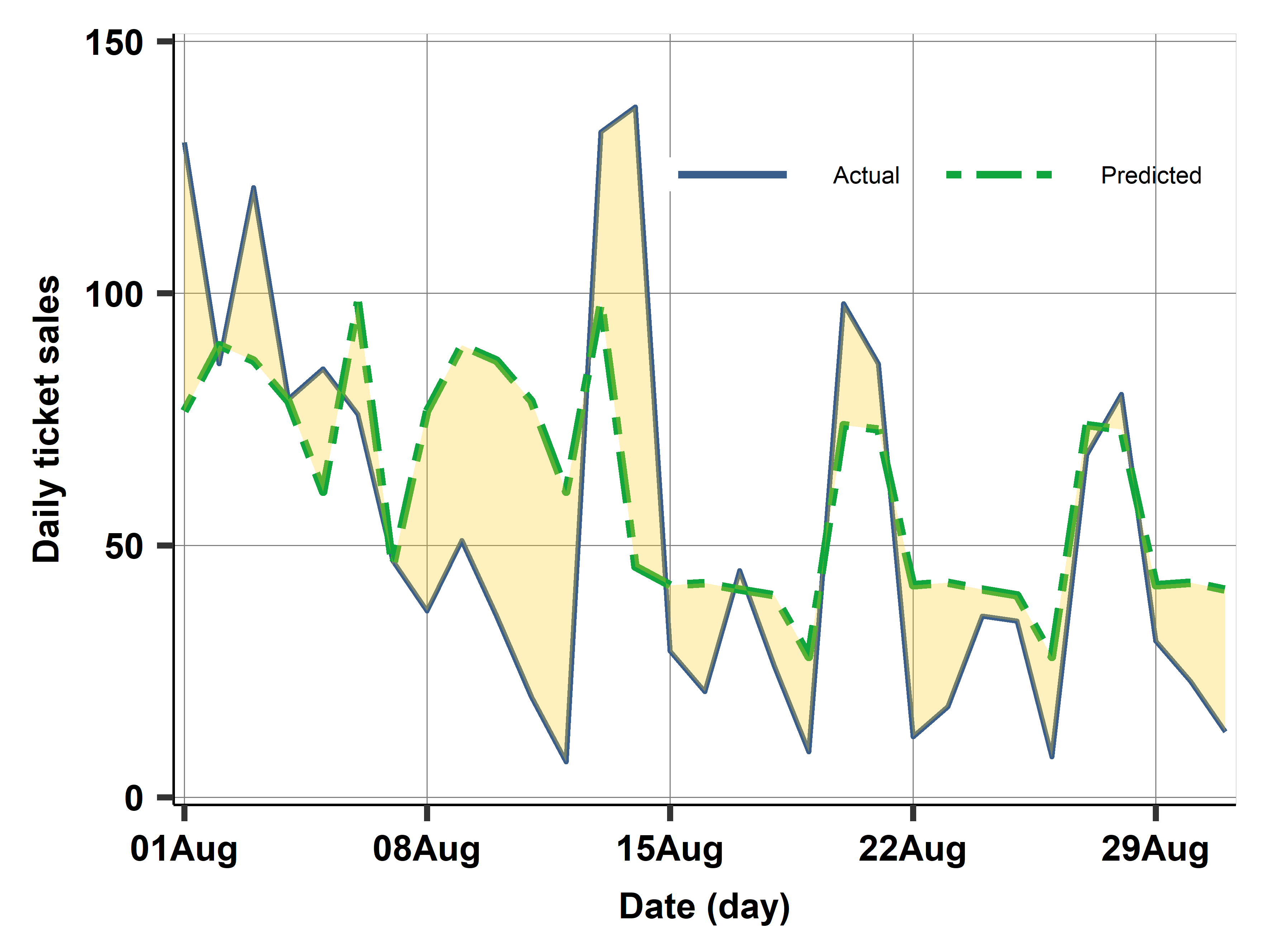

Actual vs predicted August 2016

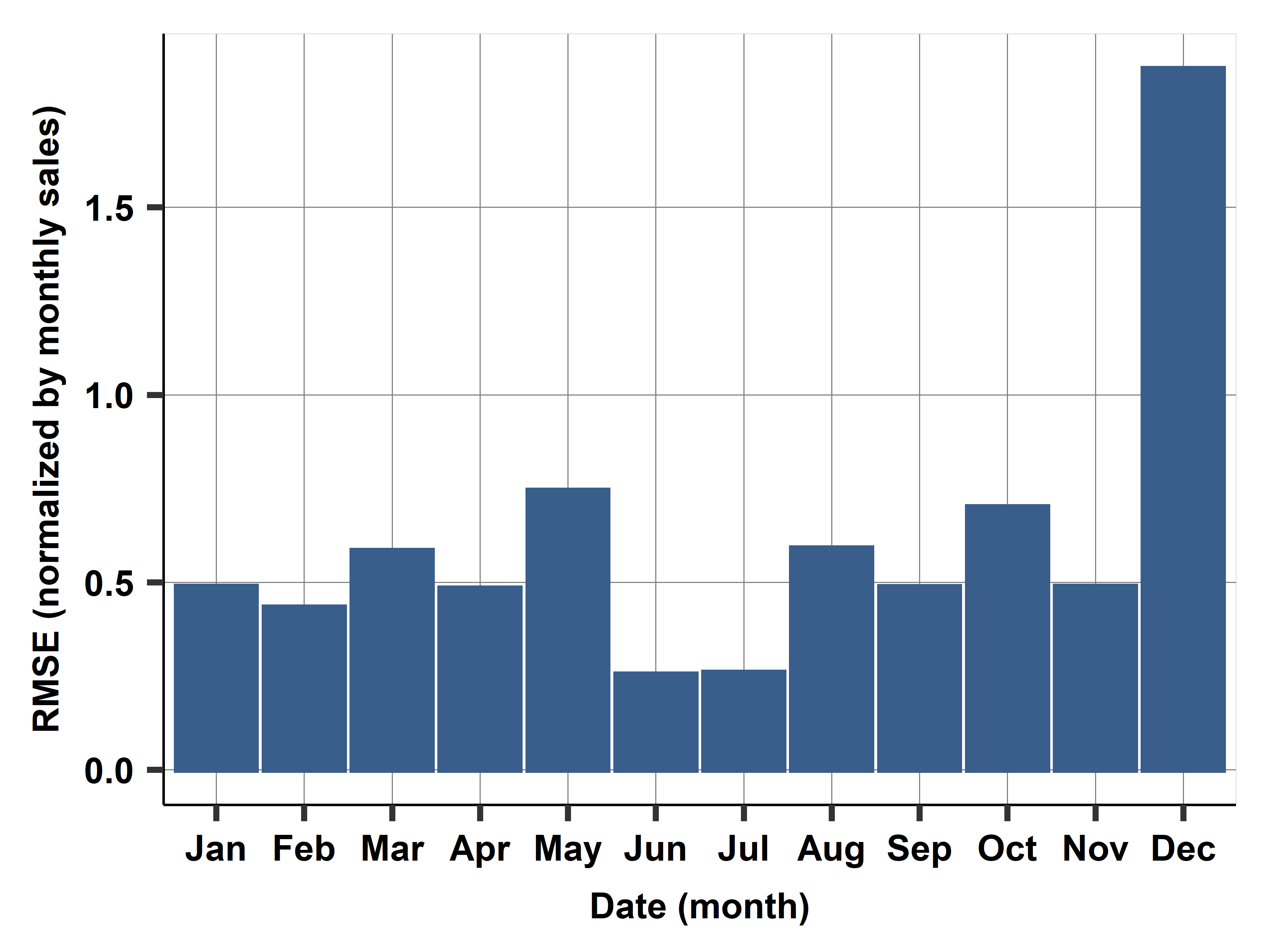

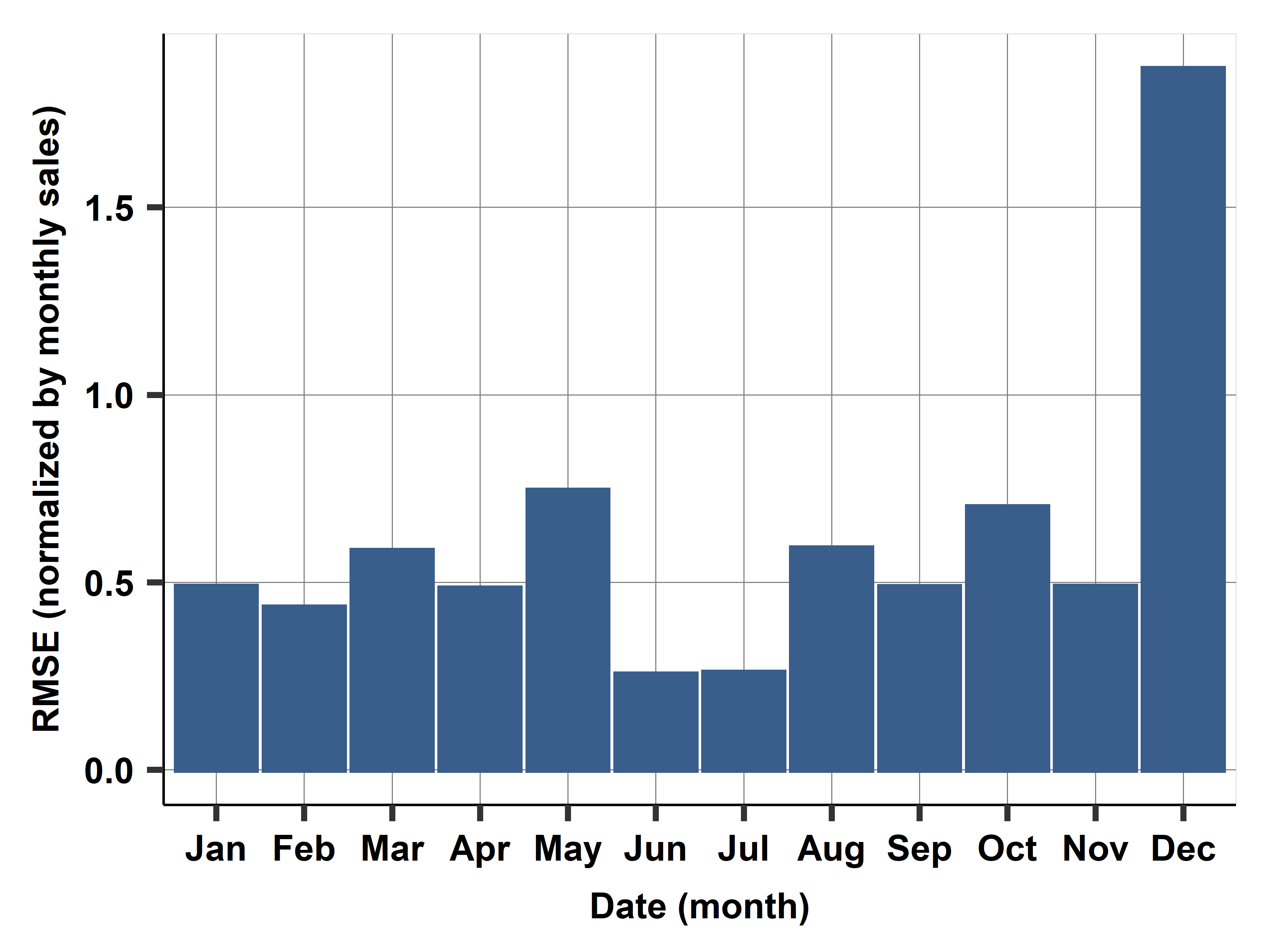

Monthly RMSE

Case study: Diagnostics vs model building

- Here we used diagnostics to learn about what to expect, strength and weaknesses of the already selected model.

- This means, no going back to drawing board.

- But, we could have said, lets run some checks on the training set and maybe alter the model accordingly.

- As we normally do with scatterplots, lowess, tabulations, etc

- Here: something weird happening in December.

- Act, build a new model and test, etc.

Short-run horizon, serial correlation and ARIMA

What you learn today, you can use tomorrow

Short-horizon forecasting: what is new?

Serial correlation is essential

- Data Depends on itself, and Errors Also Depend on Themselves

Modeling how a shock fades away \(\leftarrow\) Hopefully things “return to normal”

- Autoregressive (AR) models, capture the patterns of serial correlation – \(y\) at time \(t\) is regressed on its lags, that is its past values, \(t - 1, t - 2, etc\).

The simplest includes one lag only, AR(1): \[y_t^E = \beta_0 + \beta_1 y_{t-1}\]

Interested in estimating \(\beta_1\) or \(\rho\).

- If \(\rho = 1\) is random walk (unpredictable),

- if \(\rho = 0\) is white noise (also unpredictable, but stable).

Short-horizon forecasting: AR(1)

- One-period-ahead forecast from an AR(1):

\[\begin{aligned}

\hat{y}_{T+1} &= \hat{\beta}_0 + \hat{\beta}_1 y_T \\

\hat{y}_{T+2} &= \hat{\beta}_0 + \hat{\beta}_1 \hat y_{T+1} \\

&= \hat{\beta}_0 + \hat{\beta}_1 \hat{\beta}_0 + \hat{\beta}_1^2 y_T \\

\dots \\

\hat{y}_{T+k} &= \hat{\beta}_0 \sum_{s=1}^{k} \hat{\beta}_1^{s-1} + \hat{\beta}_1^{k} y_T

\end{aligned}

\]

ARIMA

Bringing the Big Guns

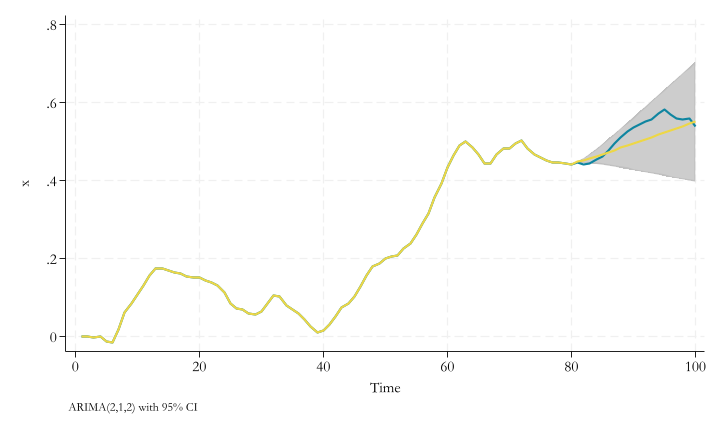

Short-horizon forecasting: ARIMA

- ARIMA(p,d,q) models that are generalizations of the AR(1) model

- can approximate any pattern of serial correlation.

- ARIMA models are put together from three parts: AR(p), I(d) and MA(q).

- but What are these?

Short-horizon forecasting: ARIMA(p,d,q)

- The ARIMA model combines three approaches to modeling time series data:

- AR(p): autoregressive models, We have seen this

- I(d): models of differences, This is new

- Relates to models that you first take the difference before modeling.

- For example \(\Delta y_t = y_t - y_{t-1} = \alpha\) is a I(1) model

- MA(q) models: moving average models: Concentrates on the error term, and how much it “depends” on past errors.

- For example \(y_t = e_t + \theta e_{t-1}\) is a MA(1) model

- \(\theta\) has to be estimated via maximum likelihood, not OLS.

ARIMA: Mix and Match

- ARIMA(2,1,0): \(\Delta y_t = \beta_0 + \beta_1 \Delta y_{t-1} + \beta_2 \Delta y_{t-2} + e_t\)

- ARIMA(0,1,1): \(\Delta y_t = \beta_0 + \theta e_{t-1} + e_t\)

- ARIMA(0,2,2): \(\Delta^2 y_t = \beta_0 + \theta_1 e_{t-1} + \theta_2 e_{t-2} + e_t\)

- ARIMA(p,d,q): \(\Delta^q y_t = \beta_0 + \sum_{i=1}^{p} \beta_i \Delta^q y_{t-i} + \sum_{j=1}^{q} \theta_j e_{t-j}+e_t\)

In practice, You rarely see \(d>2\), although \(p\) and \(q\) can be larger (depending on frequency of data)

How to choose (p,d,q)?

- Empirical approach

- Whichever works best in a cross-validated exercise!

- Try out a few and pick the one that works best

- “auto-arima” - an algo that tries out many options

- keep it simple, \(d = 0, 1\) and \(p = 0, 1, 2\) and \(q = 0, 1, 2\) rarely more

How to choose (p,d,q)?

Box-Jenkins Methodology

Step 1: Determine \(d\). Typically you test if the data is stationary (ADF test or PP test). You difference the data until it is stationary.

Step 2: To determine \(p\) and \(q\) you look at the ACF and PACF of the differenced (if applicable) data.

- ACF or Autocorrelation function

- \(corr(y_t, y_{t-1})\), \(corr(y_t, y_{t-2})\), etc.

- Helps Identify MA component (based on spikes)

- PACF or Partial autocorrelation function

- \(y_t = \beta_0 + \beta_1 y_{t-1}+ e_t\)

- \(y_t = \beta_0 + \beta_1 y_{t-1}+\beta_2{t-2} y_{t-2} e_t\),etc

- Helps Identify the AR component

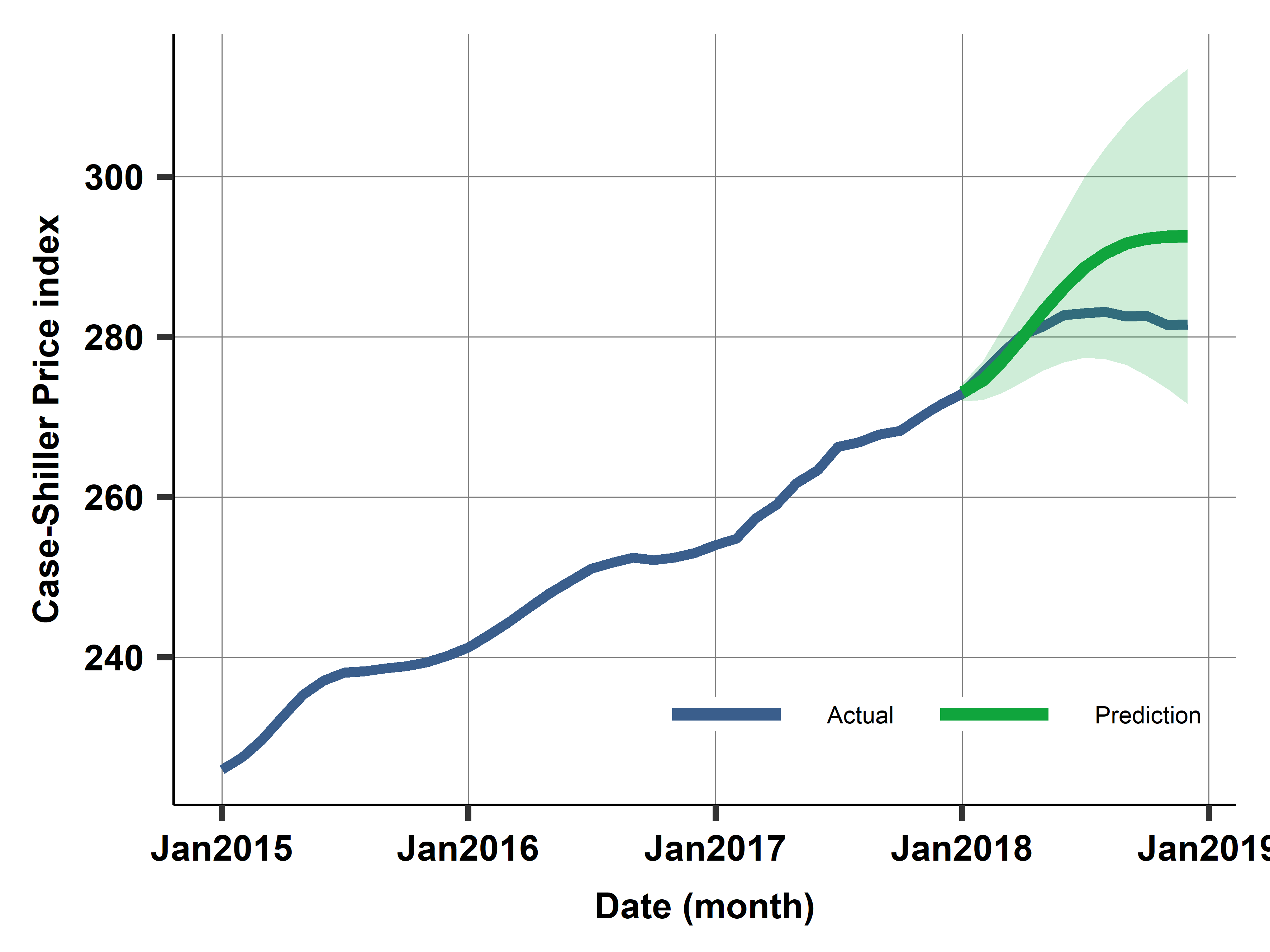

Case study: Case- Shiller home price index

- Case-Shiller home price index, Los Angeles

- Monthly index of home prices

- Data available: fred.stlouisfed.org

- Use 18 years of monthly data

Case study: Case Shiller home price data

- 18 years of data 2000-2017

- work: 2000-2016, holdout is 2017

- cross-validate with rolling window, 4-fold

- train is 2000-2012, test is 2013

- …

- train is 2003-2015, test is 2016

- Predict 12 months ahead

- RMSE - symmetric and quadratic loss

- Assume getting index right matters exactly the same

Case study: target variable

- What should be the target variable?

- The price index

- The log of the price index

- First difference <- Shortcut to assume I(1) process

- We’ll try out, and pick via cross-validation

- The model should include seasonal dummies (could be more complicated)

- The model may include a linear trend or capture it with \(\Delta y\) as target

- The model can have any form of ARIMA

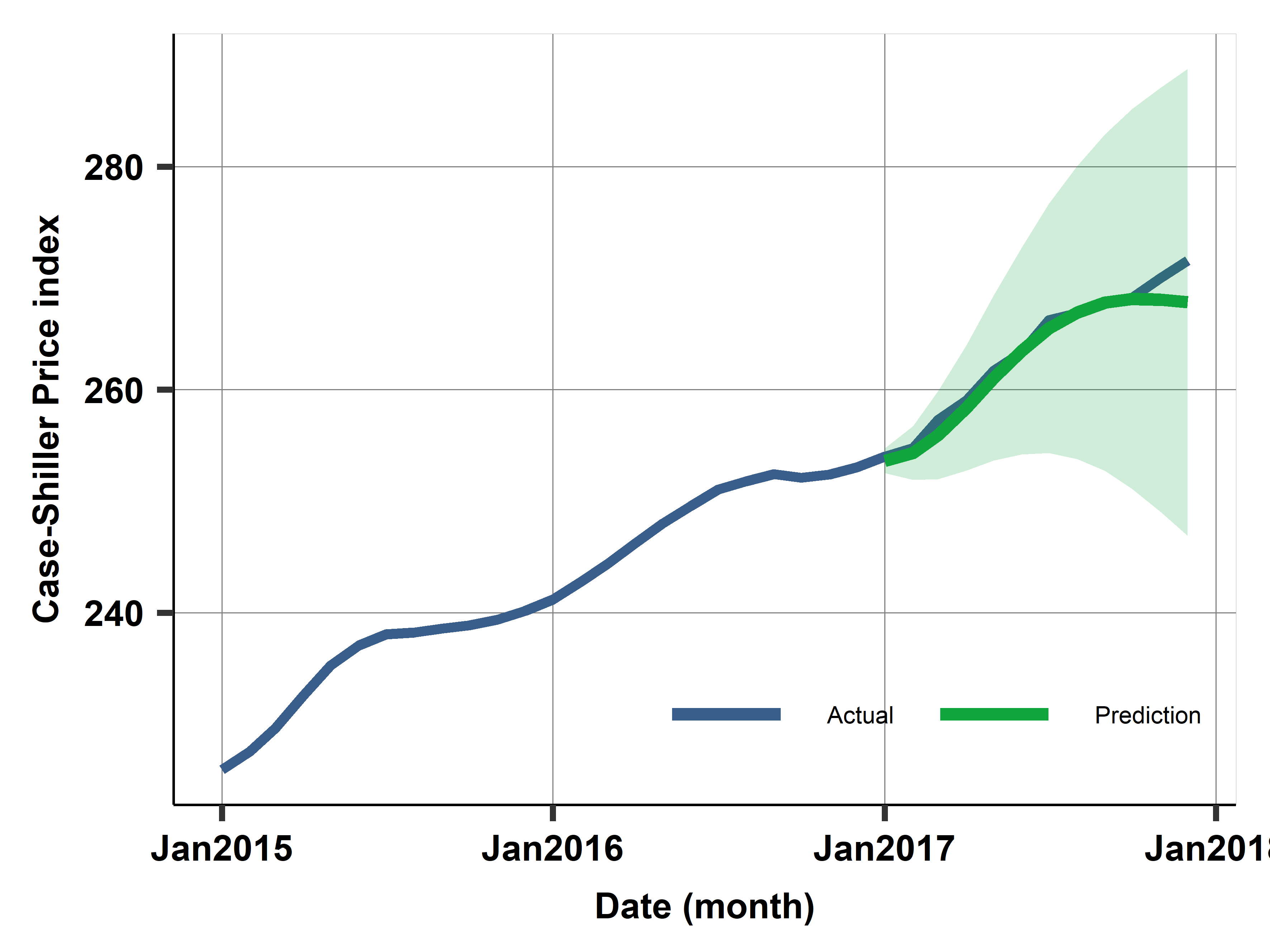

Case study: Case- Shiller home price index - prediction from ARIMA models

| M1 |

p |

NO |

X |

X |

|

|

|

31.9 |

| M2 |

p |

YES |

1 |

1 |

2 |

|

|

9.5 |

| M3 |

p |

YES |

X |

1 |

1 |

1 |

0 |

4.1 |

| M4 |

p |

YES |

X |

X |

2 |

0 |

0 |

2.3 |

| M5 |

dp |

NO |

X |

X |

|

|

|

18.8 |

| M6 |

lnp |

YES |

X |

0 |

2 |

0 |

0 |

7.2 |

Case study: Prediction with best model M4: Uncertainty

Stata Corner

In Stata, the easiest way to estimate ARIMA models is using arima command:

- ARIMA(2,2,2) model:

arima y, arima(2,2,2)

Predictions are a bit tricky. You can use predict command with the dynamic option to predict out-of-sample values. But also need to indicate “which” periods to start using the model predictions

predict yhat, dynamic(ym(2017,1)) [y]

yhat is the new variable, ym(2017,1) indicates the first period of 2017, and [y] indicates that we want to predict the “real” dependent variable. Not the changes or transformations.

No built-in option for CI predictions.

Vector Autoregression

When you need more than one variable

VAR

- Better forecasts with the help of other variables, at least for short forecast horizons.

- Need forecasts of the \(x\) variable as well – we need a model.

- Vector autoregression (VAR), is a method that incorporates other variables in time series regressions and can use those other variables for forecasting \(y\).

- Technically, you are not “ONLY” forecasting \(y\) anymore, but a set of time series regressions.

- A set of time series regressions.

\[{y_t, x_t, z_t} =W_t= \beta_0 + W_{t-1}\beta_1 + W_{t-2}\beta_2 + \dots + W_{t-p}\beta_p + e_t

\]

VAR: simplest model

The simplest VAR model has \(y\) and one \(x\) variable, and it includes one lag of each = VAR(1) model.

It assumes that all data have the same frequency. \[\begin{align*}

y_t^E &= \beta_{10} + \beta_{11} y_{t-1} + \beta_{12} x_{t-1} \\

x_t^E &= \beta_{20} + \beta_{21} y_{t-1} + \beta_{22} x_{t-1}

\end{align*}

\]

VAR forecast

One-period-ahead forecast for \(y\), only need estimates from the first one: \[\hat{y}_{T+1} = \hat{\beta}_{10} + \hat{\beta}_{11} y_T + \hat{\beta}_{12} x_T

\]

For forecasting \(y\) further ahead, we do need all coefficient estimates, and forecast values of \(x\) as well.

A two-period-ahead forecast of \(y\) from a VAR(1) is

\[

\hat{y}_{T+2} = \hat{\beta}_{10} + \hat{\beta}_{11} \hat{y}_{T+1} + \hat{\beta}_{12} \hat{x}_{T+1}

\]

and \(\hat{x}_{T+1}\) and \(\hat{y}_{T+1}\) are from the first forecast.

Forecasts for \(T + 3, T + 4, etc.,\) are analogous.

VAR characteristics

There are four important characteristics of a VAR:

- A VAR has a regression for each of the variables.

- The right-hand side of each equation has all variables.

- Right-hand-side variables are in lags only.

- All right-hand-side variables in all regressions have the same number of lags

Note: More often than not, you need the “system” to be stable/stationary. This is a bit more complex than just checking the target variable. (You need to see the Matrix of coefficients)

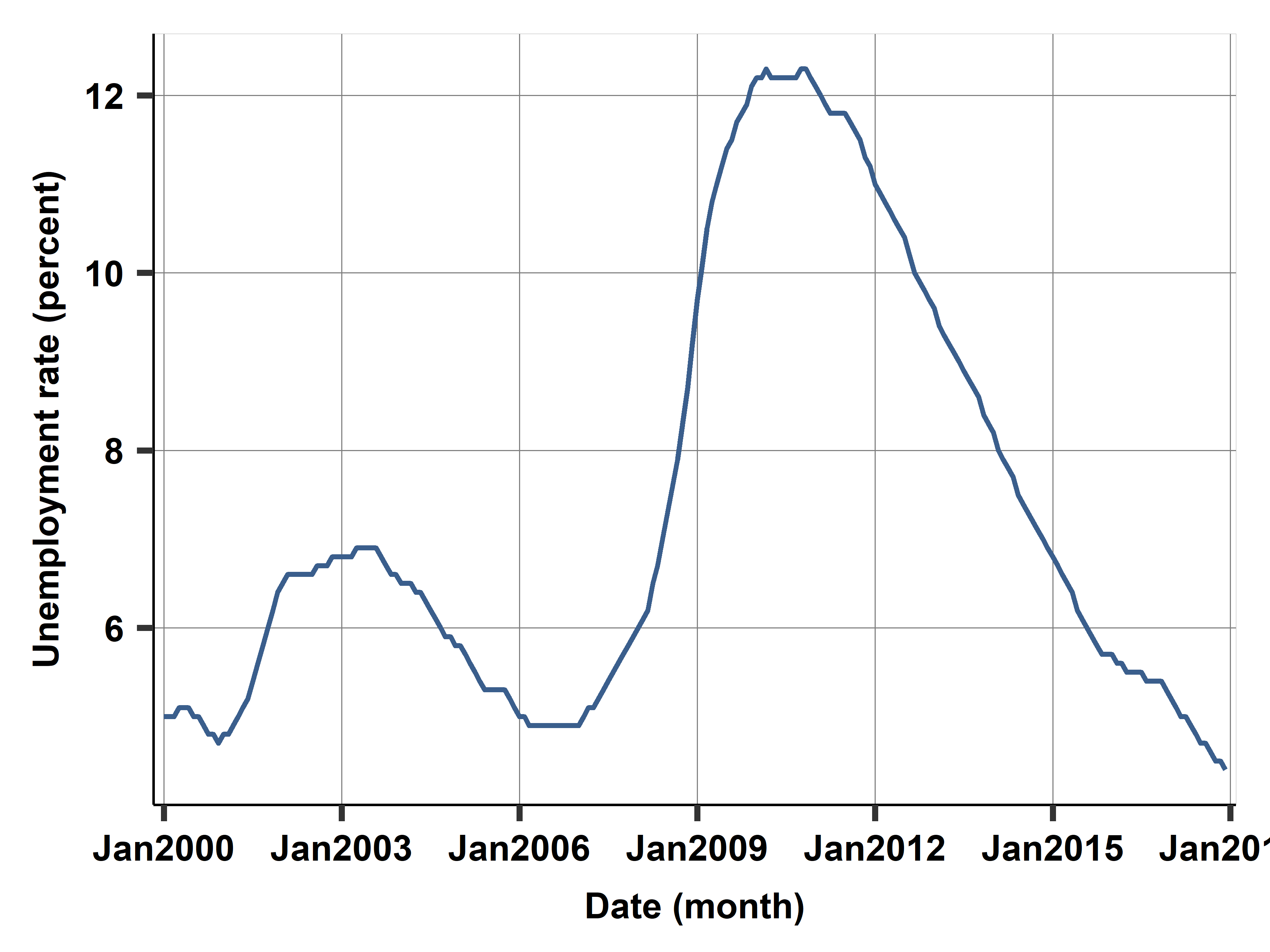

Case study: Unemployment Rate

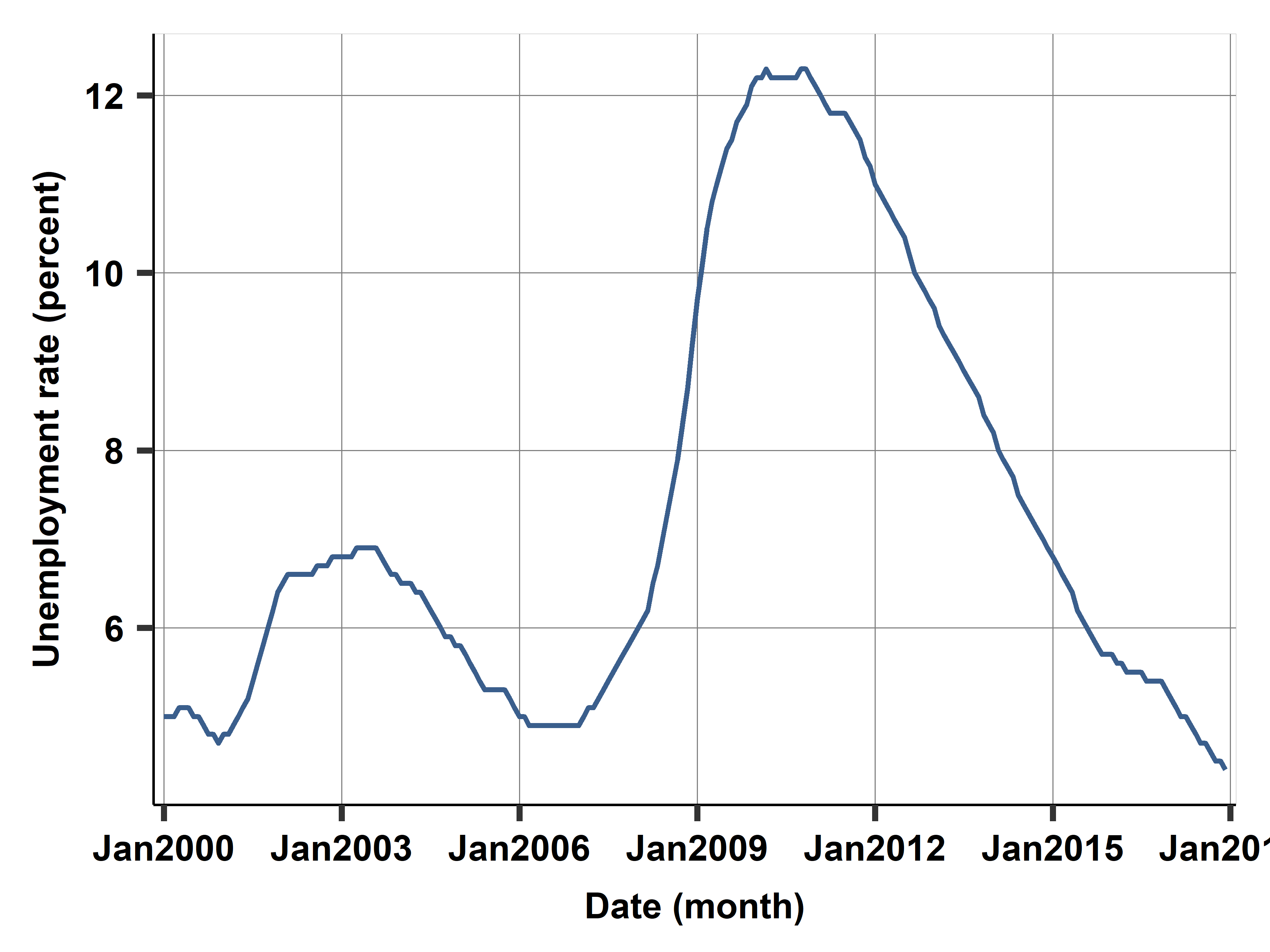

U. Rate

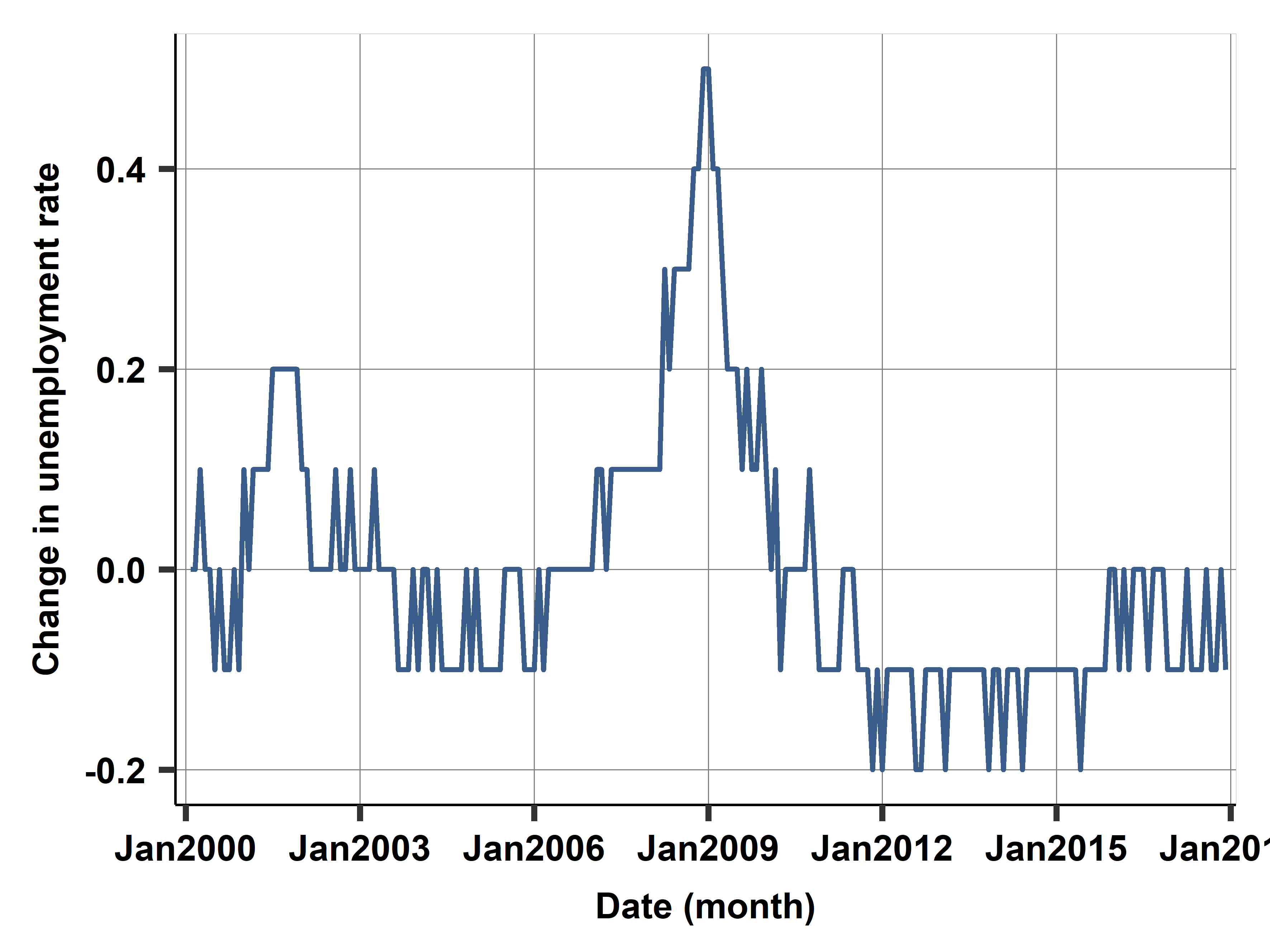

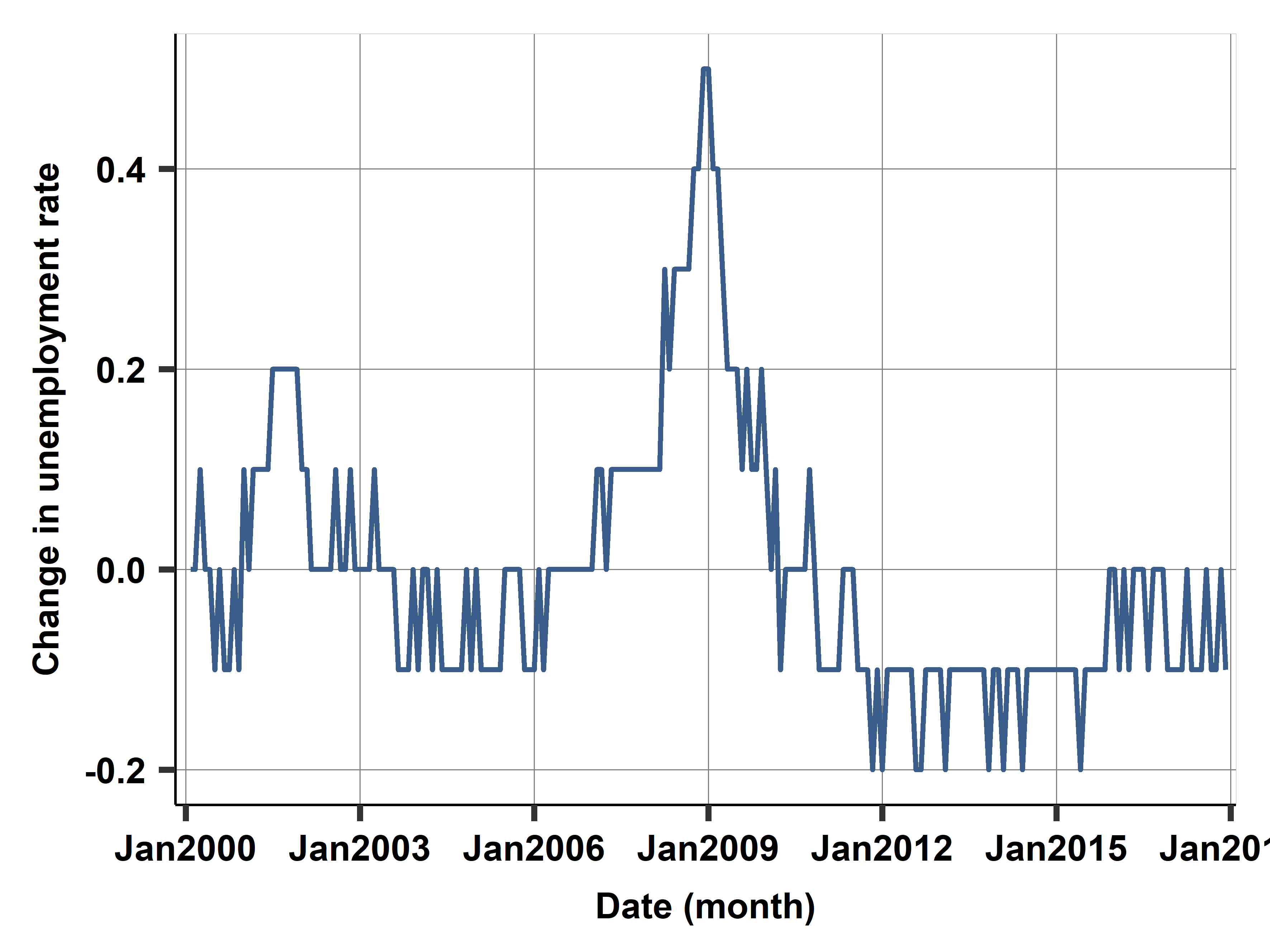

Change in U. Rate

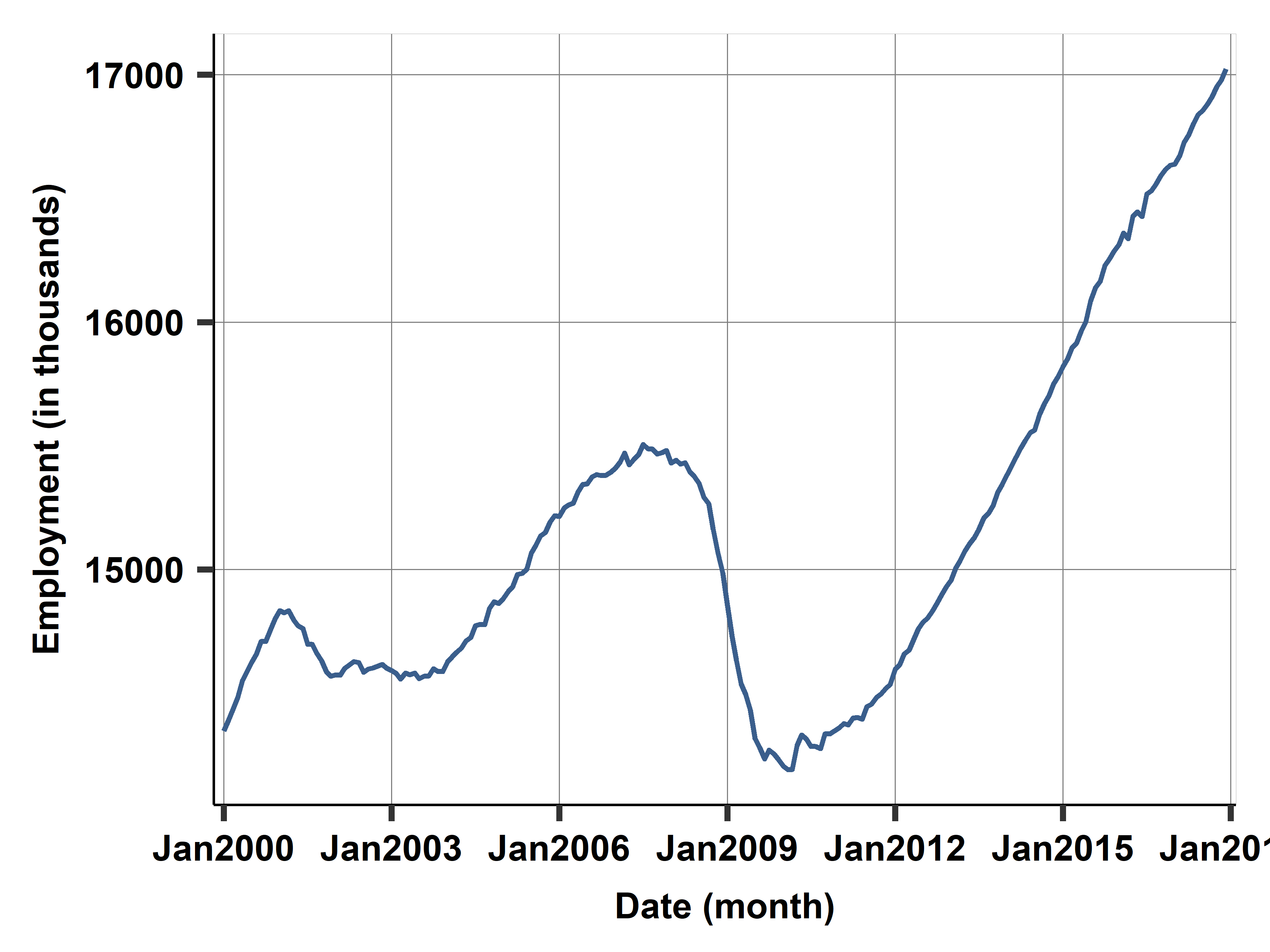

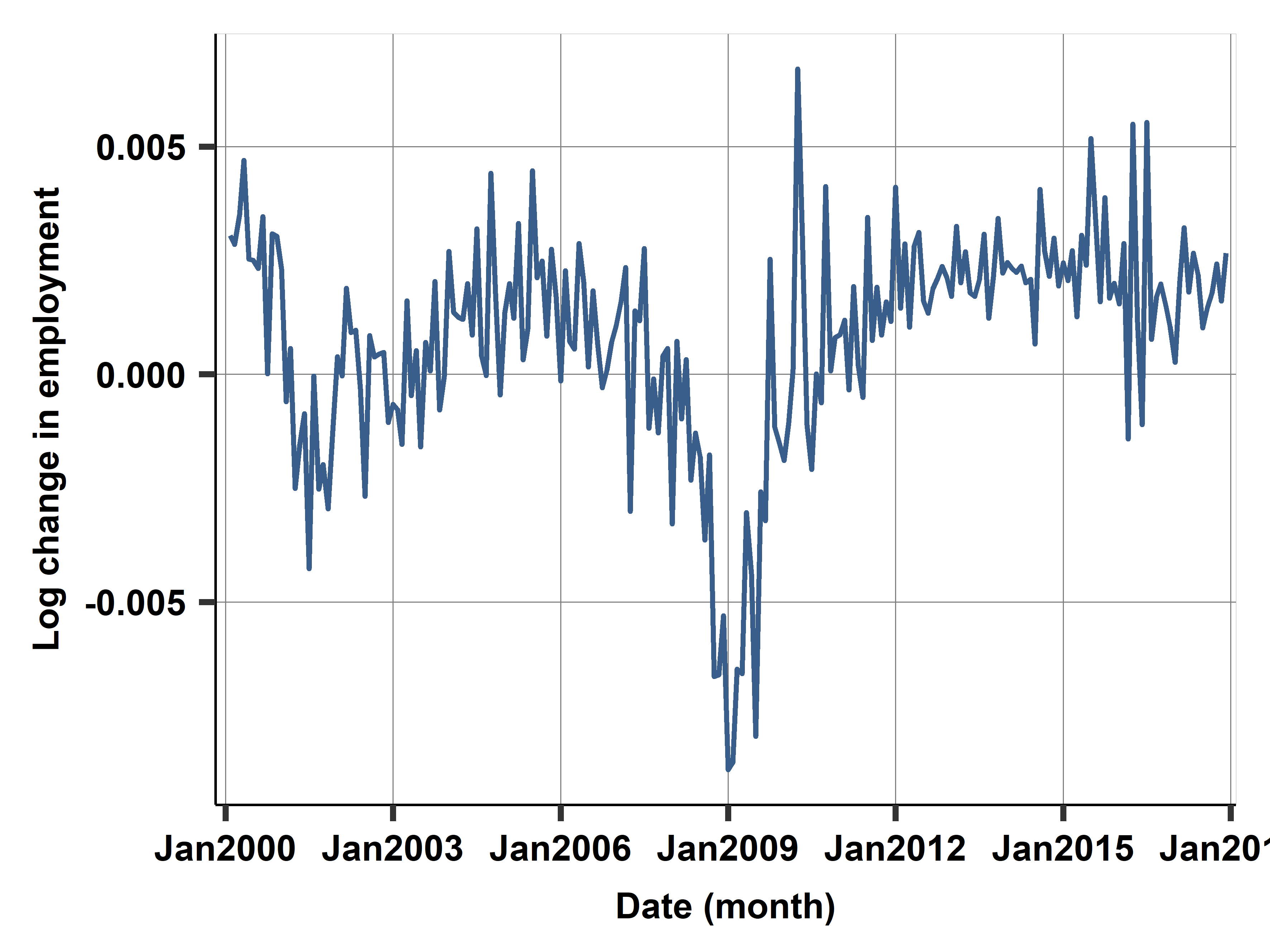

Case study: Employed Population

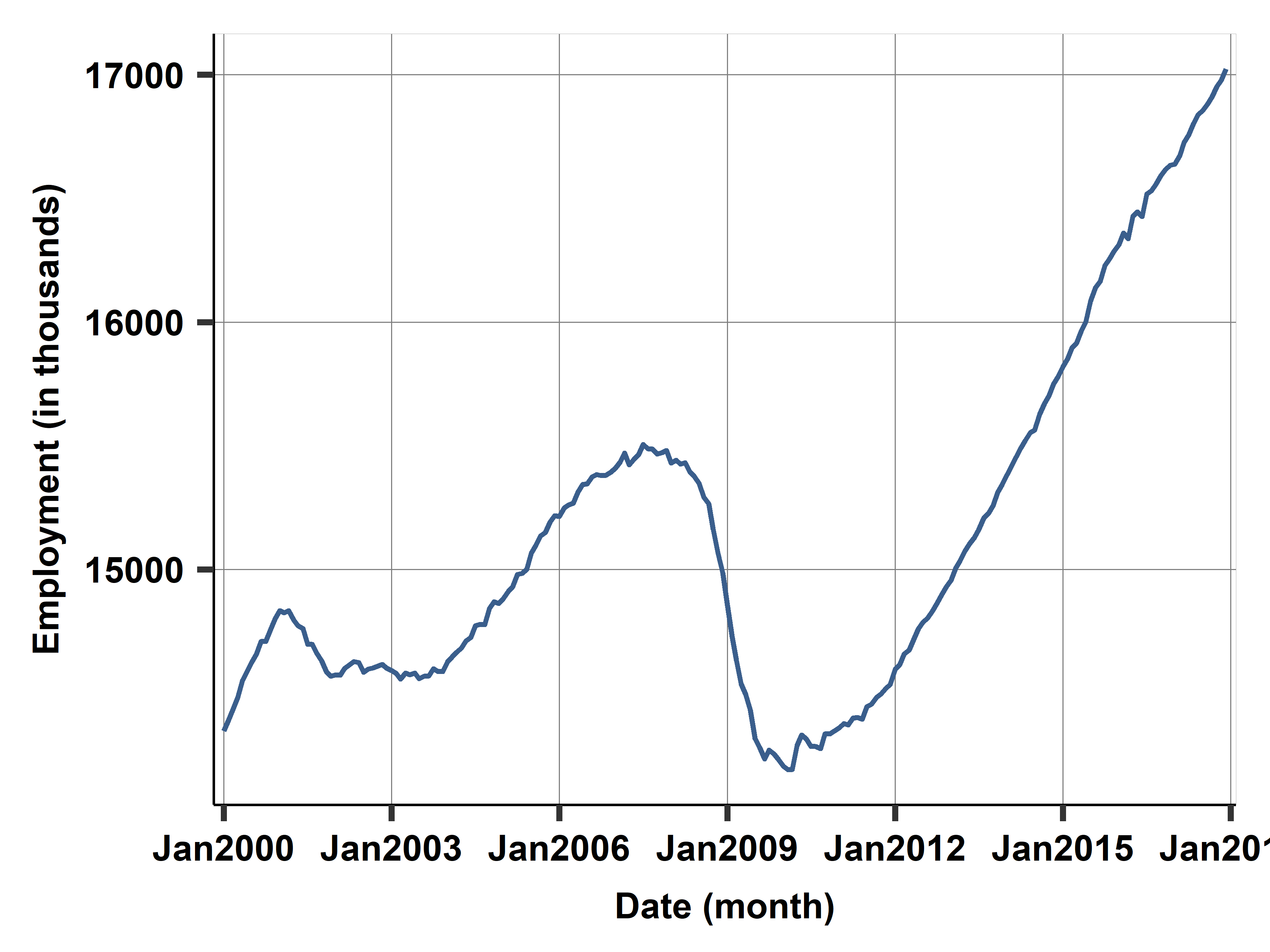

ln(emp)

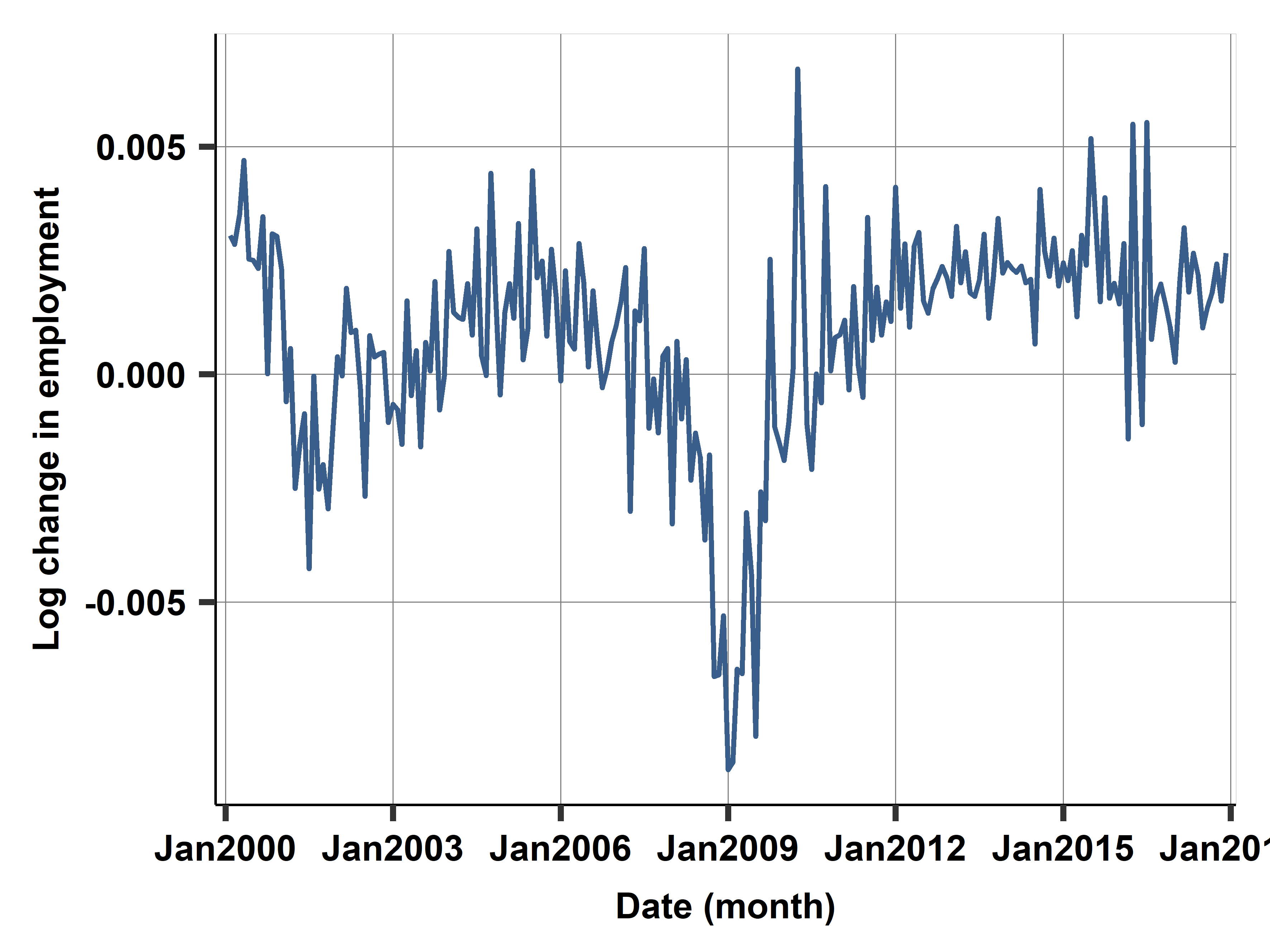

Change in ln(emp)

Case study: Case- Shiller home price index - Model selection 2

Run the VAR model and compare to previous results.

| M1 |

p |

NO |

X |

X |

|

|

|

31.9 |

| M2 |

p |

YES |

1 |

1 |

2 |

|

|

9.5 |

| M3 |

p |

YES |

X |

1 |

1 |

1 |

0 |

4.1 |

| M4 |

p |

YES |

X |

X |

2 |

0 |

0 |

2.3 |

| M5 |

dp |

NO |

X |

X |

|

|

|

18.8 |

| M6 |

lnp |

YES |

X |

0 |

2 |

0 |

0 |

7.2 |

| M7a |

dp |

VAR |

|

|

|

|

|

7.8 |

| M7b |

dp |

VAR |

X |

|

|

|

|

4.5 |

- In this case study, VAR did not improve on ARIMA.

VAR in Stata

Stata has a feature for the estimation of VAR models called…Var

var depvarlist [if] [in] [,lags(#) exog(varlist) Other]

For prediction look into fcast, predict or forecast

External validity in time series

External validity is about the stability of patterns in the data

- Such as trends, seasonality (Do they repeat? or do we need to update?)

Stationarity is what we look for:

- Distribution of the target, predictors is stable over time

- Correlation patterns also stable over time

- We can then make predictions of the future!

External validity is massive risk with time series by design: predict for future

What if we update the model with NEW data. How well would it do?

Case study: Case- Shiller home price index - model fit on test sets

Four test set (in work set) with rolling window CV. RMSE in each test set for each model.

| M1 |

14.90 |

17.58 |

34.44 |

48.58 |

31.9 |

| M2 |

14.83 |

8.39 |

6.23 |

5.52 |

9.5 |

| M3 |

6.68 |

1.39 |

3.29 |

3.22 |

4.1 |

| M4 |

2.22 |

1.96 |

2.88 |

1.20 |

2.2 |

| M5 |

33.94 |

9.79 |

10.44 |

7.39 |

18.8 |

| M6 |

2.49 |

4.95 |

9.22 |

9.54 |

7.2 |

| M7a |

13.30 |

5.85 |

3.52 |

4.28 |

7.8 |

| M7b |

5.24 |

2.51 |

5.18 |

4.75 |

4.5 |

Case study: Prediction with best model M4 for 2018

Summary

- Time series prediction is both simple and very hard

- Simple as some basic models work okay

- Model trend as first difference or linear trend

- Model seasonality, regular events

- Some basic method of capturing serial correlation

- Time series prediction model building is also very hard

- Getting seasonality, holidays, changing patterns right

- Getting target variable and ARIMA(p,d,q) selection needs competing models

- Most importantly: external validity is a huge problem

- Stability may easily break down, and there is nothing we can do.